child tax credit september delay

September 18 2021 228 PM 6 min read. Americans may be planning ahead as they know their tax situation may change and dont want.

Sustainability September 1 2020 Browse Articles

After the July and August payments the first two in the special 2021 child tax credit payment schedule were made on time the September one is taking longer for some.

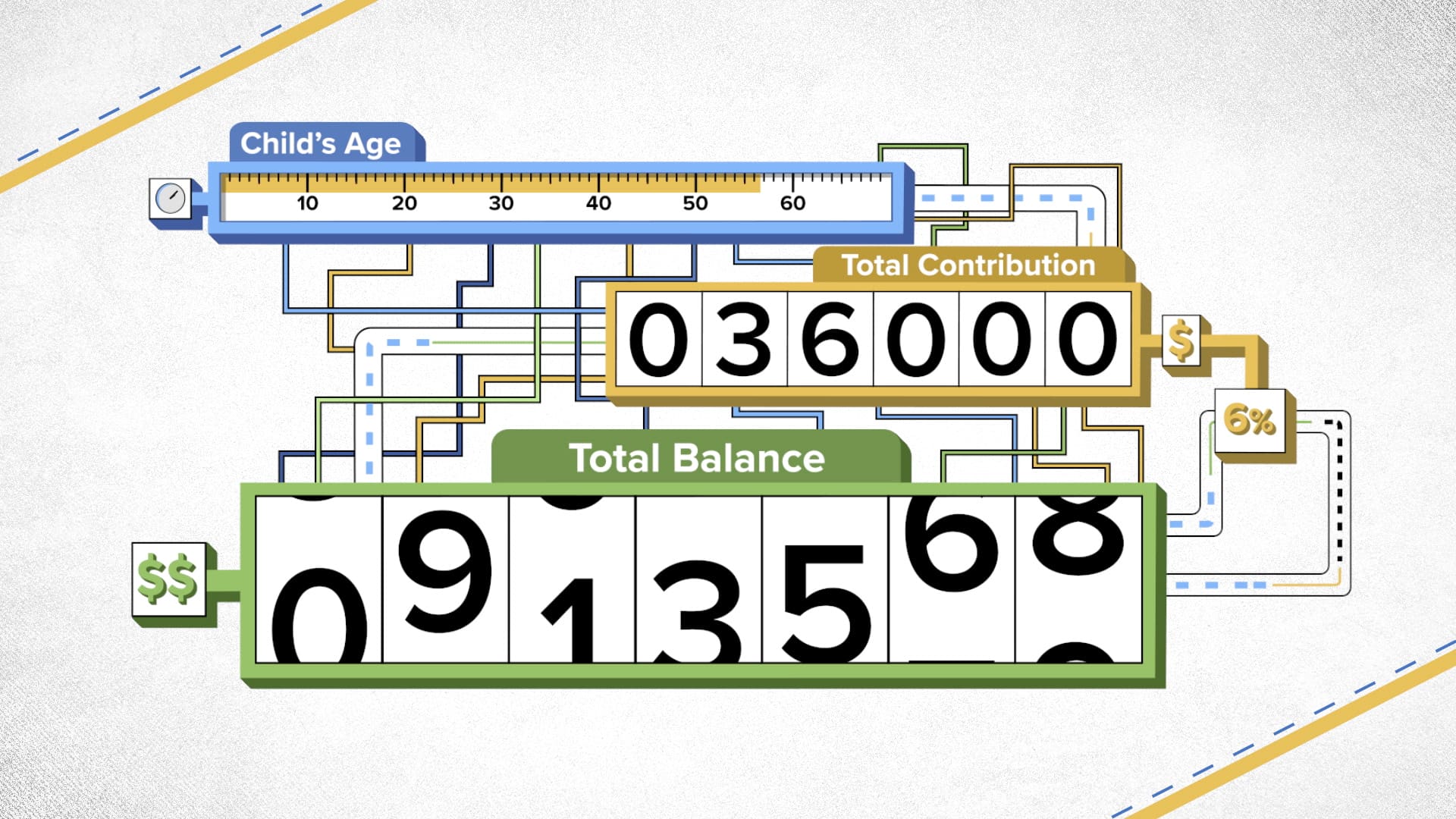

. That drops to 3000 for each child ages six through 17. Simple or complex always free. For this year only the Child Tax Credit is worth up to 3600 for children under the age of 6 and up to 3000 for children aged 6 to 17.

This isnt a problem to do. This third batch of advance monthly payments totaling about 15 billion is reaching about 35. According to reports the IRS began sending out the late payments on Friday of last week.

According to the IRS the September payment will be disbursed starting on. And late Friday the Internal Revenue Service acknowledged that a group of people are facing roadblocks. The IRS is paying 3600 total per child to parents of children up to five years of age.

17 that it was aware. Parents may be saving up for a luxury holiday or they may want to pay off some bills according to CNET. Treasury sends the first monthly round of CTC advance payments to families of more than 60 million children.

IR-2021-188 September 15 2021. 100s of Top Rated Local Professionals Waiting to Help You Today. In a statement IRS realized that the individuals rely on getting these payments on schedule.

The IRS on Friday release declared that due to a technical issue the payments for the last month got delayed for a small number of advance child tax credit recipients in September has now been sorted while explaining about the fourth monthly payments of the program. Congress fails to renew the advance Child Tax Credit. October 16 2021 by Rahis Saifi.

The Internal Revenue Service failed to send child tax credit payments on time to 700000 households this month and some are still waiting for. The 2021 advance was 50 of your child tax credit with the rest on the next years return. The third round of child tax credit payments due to millions of American families are going to start going out Wednesday.

They also apologized for the delay. Join The Millions Who File Smarter And Get Your Taxes Done Right Guaranteed. Ad Get Your Maximum Refund Guaranteed Even If Youve Received The Advance Child Tax Credit.

But the IRS did not detail what went wrong or state. Technical issue delays some Advanced Child Tax Credit Payments until Oct 1 About 2 of the September payments were delayed. Ad File a federal return to claim your child tax credit.

Families may want to receive a bumper child tax credit next year once tax returns are filed in April. HUNDREDS of parents across the United States are feeling frustrated with Septembers child tax credit as more than 30million families were expecting to receive the Covid relief money last week. Including the last half of the tax credit recipients could get a total of up to 3600 per child 5 years old and younger and 3000 for every child between 6 to 17 years old.

Delayed child tax credit payment leaves parents fuming but IRS promises you should get it soon. 1637 27 Sep 2021. The Internal Revenue Service said Sept.

The first half of the credit is being delivered in monthly direct deposits from July through December of 300 for children under 6 and 250 6. Many parents continued to post their frustrations online Friday about not receiving their September payments yet for the advance child tax credit. September 26 2021 103 PM.

Payments began in July and will continue through December with the remaining. The deadline to un-enroll is Monday October 4 at 1159pm. The Internal Revenue Service IRS sent out relief payments on September 15 worth up to 300 per child but more than 200 parents have complained they.

In total the IRS is issuing about 15 billion in Child Tax Credit money each month to households who qualify and its had a significant impact on. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now receiving their advance Child Tax Credit CTC payment for the month of September. The expanded child tax credit pays up to 300 per child ages 5 and younger and up to 300 for children ages 6-17.

Child Tax Credit September Payment Delays Resolved. Fortunately the IRS seemed to have found a solution to the problem. Biden and Harris mark start of monthly Child Tax Credit payments 1555.

Some eligible parents who are missing their September child tax credit payments should get them soon. Also while the credit is normally paid as a single lump. Chris Walker 37 a journalist in Madison Wisconsin told CBS MoneyWatch he was expecting a 250 Child Tax Credit payment.

How To Write A Check And Balance Your Checkbook Writing Checks Check And Balance Financial Advice

What To Know About September Child Tax Credit Payments Forbes Advisor

![]()

September Child Tax Credit Still Not Issued R Stimuluscheck

Irs Child Tax Credit 2021 Update Advance Payment Date For November Revealed And Opt Out Deadline You Must Act Before

Canadian Tax News And Covid 19 Updates Archive

Will Monthly Child Tax Credit Payments Be Renewed Forbes Advisor

Tax Return Deadlines 2021 Tax Deadline Tax Return Deadline Tax Refund

Child Tax Credit Dates 2021 Latest August 30 Deadline To Opt Out Of September Payments As Parents Flock To Irs Portal

Canadian Tax News And Covid 19 Updates Archive

Missing A Child Tax Credit Payment Here S How To Track It Cnet

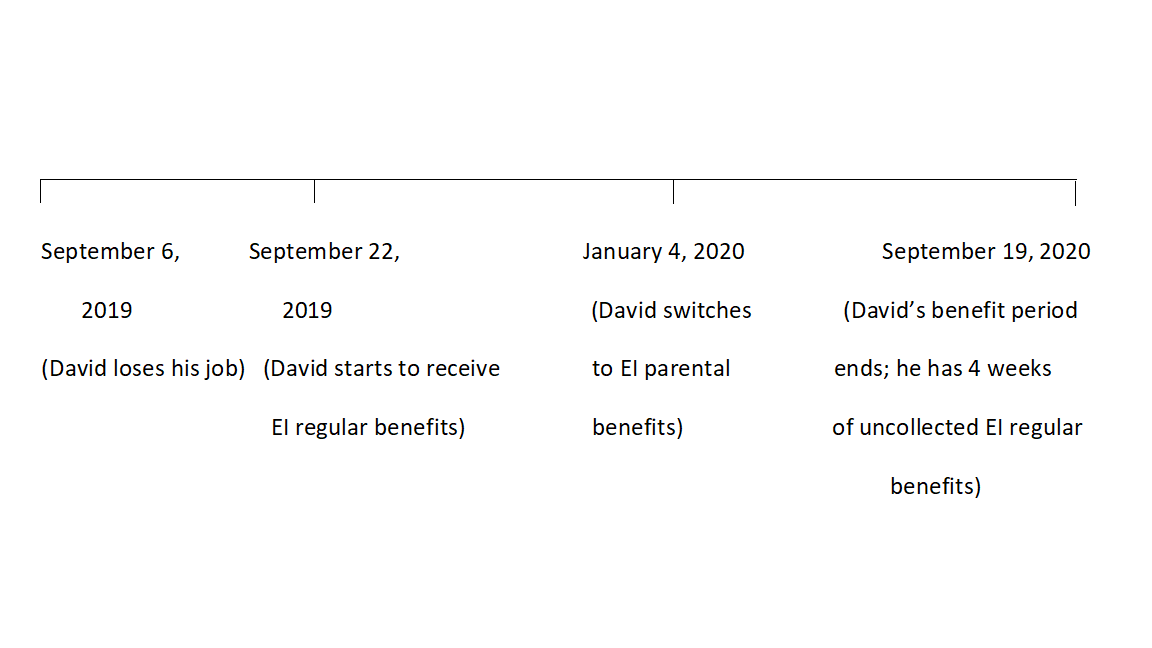

Chapter 2 Impact And Effectiveness Of Employment Insurance Benefits Part I Of The Employment Insurance Act Canada Ca

Latest Child Tax Credit Payment Delayed For Some Parents Cbs News

Time Is Running Out To Sign Up For Advance Child Tax Credit Checks